POS Terminal in Action

Represents card-present transactions

Mobile SoftPOS & QR Payment

Represents flexibility and

modern merchant tools

Real-Time Dashboard Monitoring

Highlights business intelligence

& reporting

Merchant Signup / Onboarding Interface

Depicts easy onboarding and

multi-channel coverage

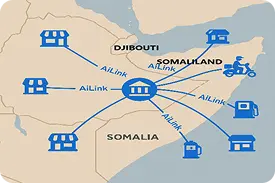

AILINK Merchant Ecosystem Map

Shows scale and reach of

acquiring network

E-Commerce Integration

Captures online merchant

acquiring capability

Mobile Solutions

Mobile solutions for digital payments encompass a variety of technologies and platforms that allow users to make transactions using their mobile devices. These solutions include mobile wallets, which store payment information and loyalty rewards, and mobile payment apps that enable users to pay for goods and services using methods like NFC or QR codes.

Key aspects of mobile payment solutions:

Mobile Wallets

These apps act as virtual wallets, storing payment information, loyalty cards, and coupons, allowing users to make payments at physical stores and online. Examples include Apple Pay, Google Pay, and Samsung Pay.

Tap-to-Pay (NFC)

Near Field Communication (NFC) technology allows users to make payments by tapping their mobile devices on compatible payment terminals.

How they work:

Benefits of mobile payments:

Convenience:

Mobile payments offer a quick and easy way to pay for goods and services, eliminating the need for cash or physical cards.

Accessibility:

Mobile payments can be used by a wide range of users, including those who may not have access to traditional banking services.

Security:

Mobile payment solutions often incorporate security measures like encryption and tokenization to protect user data.

Efficiency:

Mobile payments can streamline the checkout process, reduce transaction times and improve customer experience.

Begin your journey to financial success with our comprehensive services

Transform your financial future.